Global Trading

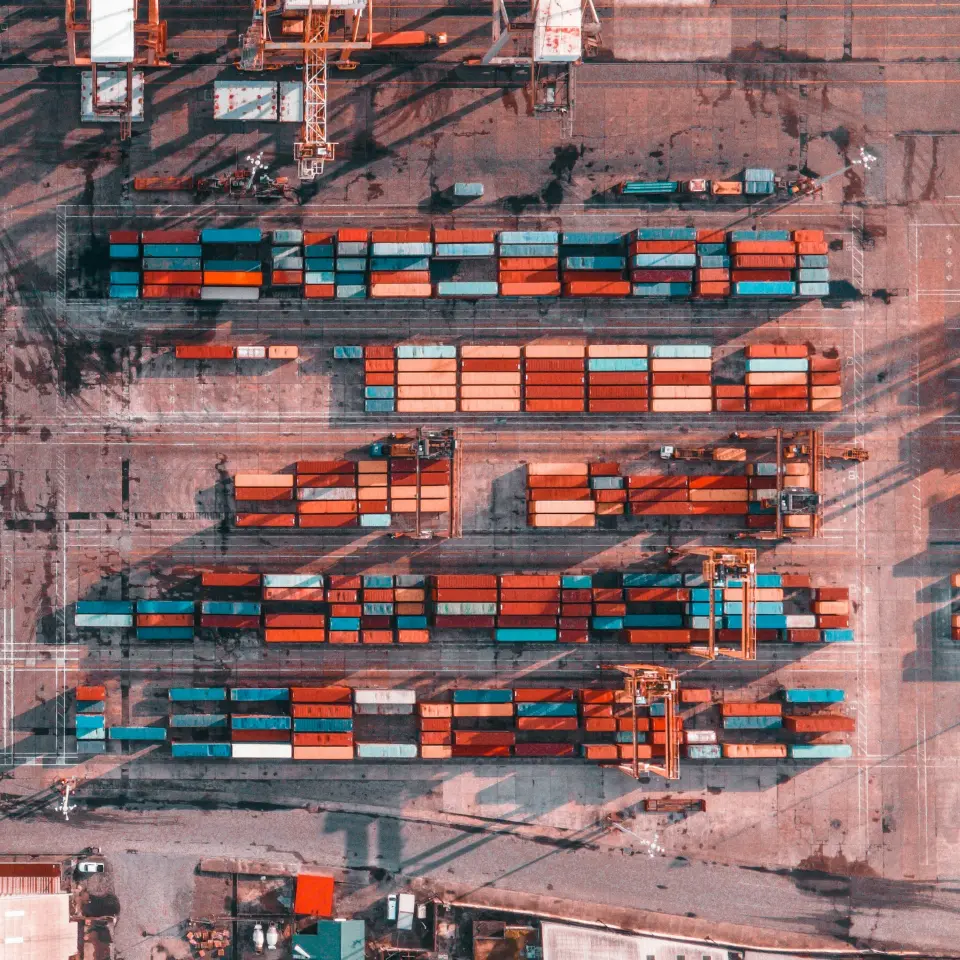

Aurillo’s Commodity Trading vertical plays a focused and integral role in India’s evolving market economy by facilitating structured trade and transparent price discovery in the agricultural commodity space. Our participation in regulated futures and options markets is purpose-driven—connecting upstream producers and downstream users with financial instruments that enhance certainty, reduce volatility, and ultimately improve decision-making in supply chains.

Commodity markets are not simply venues for speculative movement; they are the infrastructure upon which producers, aggregators, processors, and consumers hedge risk, plan inventories, and forecast cash flows. Aurillo engages these markets with intent. We trade across a clearly defined basket of agricultural commodities that are essential to India’s consumption base and trade corridors. These include cereals, oilseeds, pulses, and spices—each chosen based on seasonality, liquidity, and underlying physical market relevance. Our desk does not treat contracts as disconnected financial instruments. Every commodity we engage with is studied from the ground up—sowing cycles, weather patterns, harvest estimates, transportation trends, and warehousing constraints all feed into our trade models. We ensure that our strategies are underpinned by real economic activity, and that every trade contributes to more stable and efficient markets.

We prioritize depth over breadth. Our portfolio is composed of commodity contracts that demonstrate historical liquidity, active producer participation, and meaningful delivery volume. Rather than chasing scattered opportunities, we commit to a focused set of contracts where we can contribute consistent liquidity and extract repeatable value for ourselves and our clients. We are also actively involved in trading return-based indices that aggregate key agri-commodities into a single structured product. These indices serve as hedging instruments for diversified exposures and enable a new class of institutional strategies that operate at the intersection of agriculture and asset management

Our order placement is governed by rule-based systems that combine historical pricing data, forecast models, and real-time market depth. Whether we are entering the market for short-duration trades or taking positions over roll periods, each order reflects a balance of internal modeling and ground-level intelligence. Aurillo’s execution desk does not operate in isolation—it is supported by a continuous stream of market commentary, procurement feedback, and trade ecosystem insights. We recognize that agricultural commodities carry unique volatility due to factors beyond financial markets—monsoon anomalies, procurement policy changes, export-import bans, and storage fluctuations. Our systems are designed to adapt to these shifts, not to ignore them.

Beyond trading, we are involved in schemes that enhance contract liquidity—especially in contracts that are strategically important but under-traded. Our presence helps stabilize bid-ask spreads, provide reference pricing for physical market participants, and improve visibility in contracts that may otherwise face roll disruptions or stagnation. By doing so, we support the development of a more resilient commodity market framework—one that serves not just traders, but farmers, logistics players, processors, and end-consumers.

We are not in the business of speculative price chasing. Our mission is to enable commerce through structured participation, informed engagement, and a clear understanding of commodity fundamentals. We bring discipline to trading, credibility to pricing, and clarity to hedging. Aurillo’s Commodity Trading vertical stands not only as a participant in markets but as a builder of market efficiency. As India continues to formalize its commodity value chains and shift toward market-based pricing, our role is to bridge financial structures with real-world trade—responsibly, consistently, and with purpose.